accurate income tax calculator

Your average tax rate is 220 and your marginal tax rate is 353. Canada income tax calculator.

Personal Income Tax Solution For Expatriates Mercer

It aids taxpayers in three ways.

. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Tax preparation tax return and tax refund. Accurate online income tax calculators.

It includes everything tax unemployment insurance payment pension avarege municipality tax avarege church tax So basically you would make 50kyear and you would get 33 674year paid to you which is 2806month. It can also be used to help fill steps 3 and 4 of a W-4 form. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

We offer two convenient locations in the muskegon area and a location in fremont. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 100s of Top Rated Local Professionals Waiting to Help You Today.

When it comes to Tax Calculators in Australia UK or NZ the best ones would be from the original source. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Accurate online income tax calculators. Up to 3 LPAlakhs per annum no tax is required. While the income taxes in California are high the property tax rates are.

The amount of tax payable will vary depending on which slab your total income lies. Taxation systems can be complex. If you live in Helsinki the or bigger cities the municipality tax is a bit.

Crossposted by 8 months ago. Up to 10 cash back Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021. Developed by Chipsoft now Intuit Incorporated in the mid-1980s it helps users in the tax filing process of their federal and state income tax returns.

This uk tax calculator will make light work of calculating the amount of take home pay you should have after all income. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined. This calculator is intended for use by US.

That one gives you a quite accurate estimate. Use tab to go to the next focusable element. Answer 1 of 3.

The Turbo Tax Calculator is one of the most popular types of tax software. Updated for the 2022-2023 tax year. Today we are going to build an Income Tax Calculator Project in Java.

Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Tax Care aims to take you easy and stress out of income tax matters.

Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Find out your federal taxes provincial taxes and your 2021 income tax refund. Employed self employed or construction industry. The individual income tax rate in puerto rico is progressive and ranges from 0 to 33 depending on your income.

This tax calculator can provide accurate tax calculations for three different types of employment structure. I also do plan on continuing to work for this company as the pay is great and I was granted 500k in RSUs in the new company vesting over 4yrs. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Additionally health and education cess at 4 are levied on the total tax rate above the total amount payable. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. All incomes above 3 LPA are subjected to a total of 3 Education.

Ad TaxInterest is the standard that helps you calculate the correct amounts. That means that your net pay will be 40568 per year or 3381 per month. I just wanted to add that this is pre-tax so I do need to pay the taxes on the 52 which will leave me with 26 TBD after I meet with a CPA and thats still loads.

Accurate income tax calculator. In Australia go to the Australian Taxation. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Our Tax Experts prepare your 100 accurate income tax return by availing genuine income deduction and exemption and getting you more TDS refund. Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Look at this table to make things clear. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Now file Income Tax Return and save your taxes with Tax Care the fastest easiest and accurate way to do your income taxes.

It provides a step-by-step guide and.

What Is The Formula To Calculate Income Tax

2021 2022 Income Tax Calculator Canada Wowa Ca

German Income Tax Calculator Expat Tax

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Free 12 Sample Income Tax Calculator Templates In Pdf

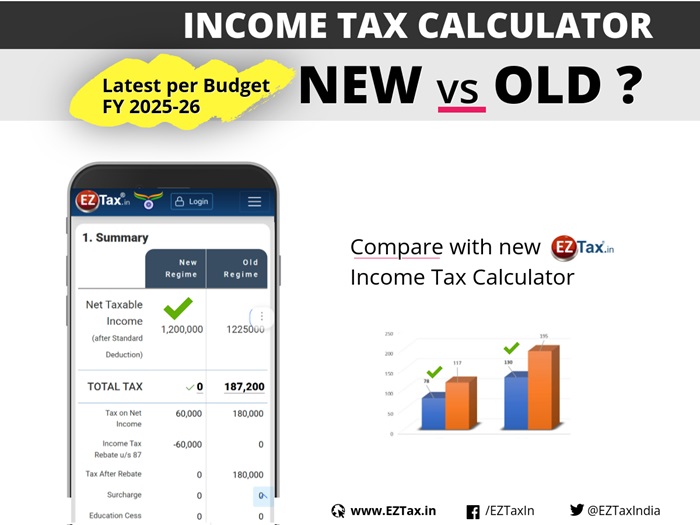

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

German Wage Tax Calculator Expat Tax

How To Calculate Income Tax In Excel

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Paycheck Calculator Take Home Pay Calculator

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

German Income Tax Calculator Expat Tax

Personal Income Tax Solution For Expatriates Mercer

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Foreigner S Income Tax In China China Admissions